Navigate the Future of

Navigate the Future of

Inclusive Investment

Inclusive Investment

Ensure compliance and drive smarter investments with Reliabl's Data Compass. Our easy-to-use platform streamlines portfolio industry tagging and mandated demographic data reporting while providing valuable insights into portfolio performance.

Trusted by

Why Data Compass?

Enhanced Data Quality

Our software meticulously collects, stores, and anonymizes founders' diversity data, guaranteeing the highest standards of data quality.

Effortless Compliance

Our intuitive platform automates demographic data reporting, reducing administrative burden and minimizing errors.

Informed Portfolio Decisions

Most VCs are missing crucial diversity data in their decision-making process. Our tool provides comprehensive insights into diversity trends, filling this gap.

Key Features

Key Features

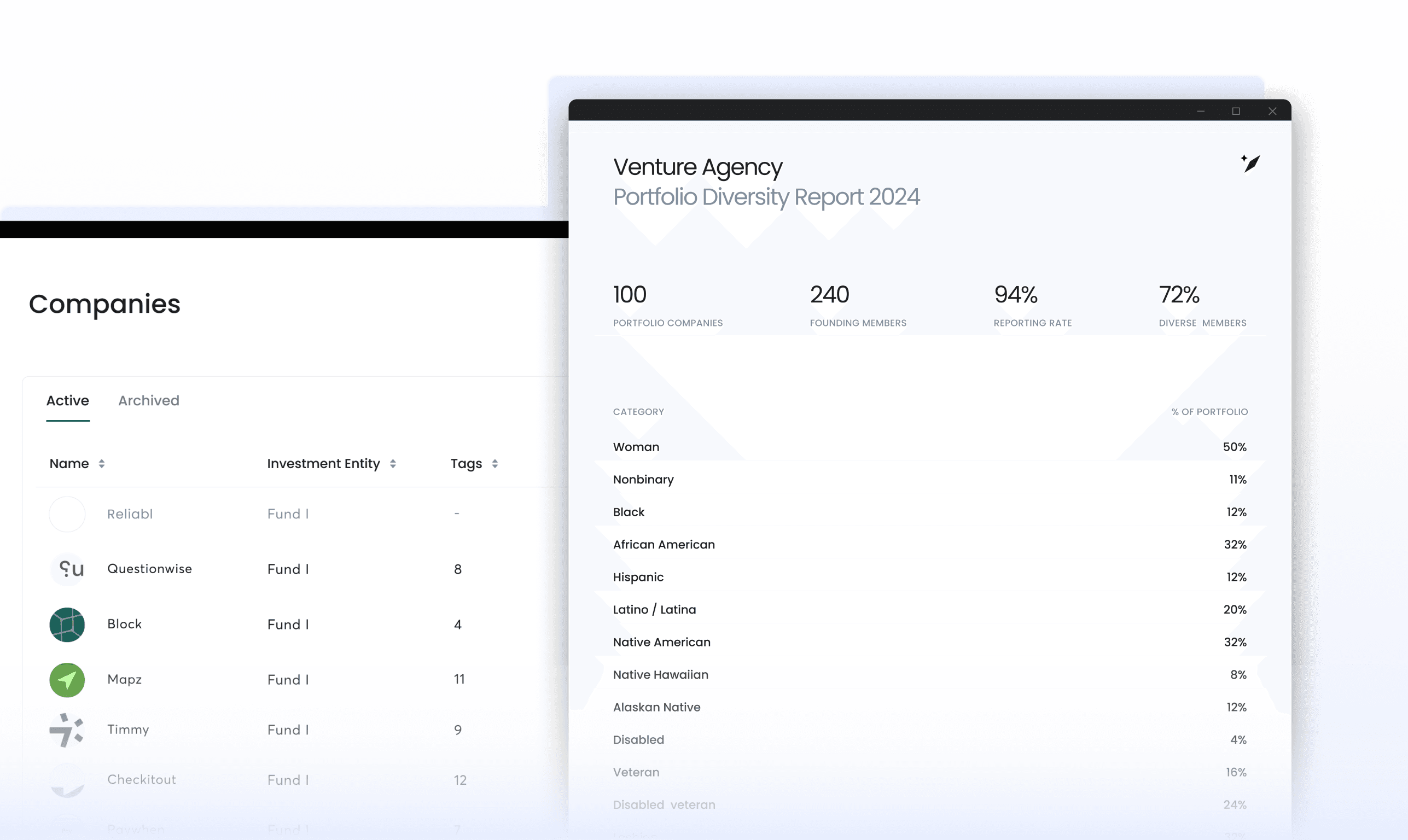

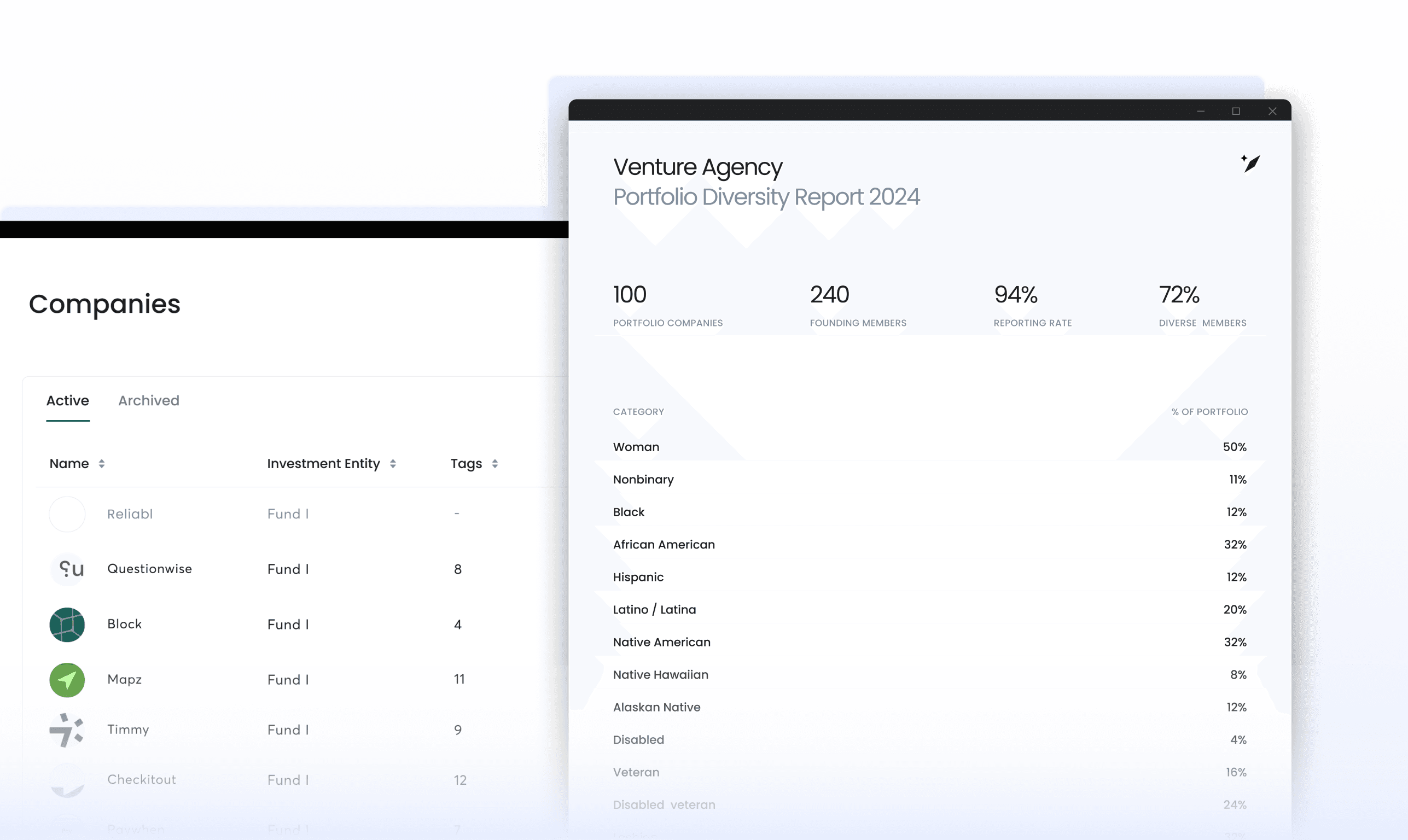

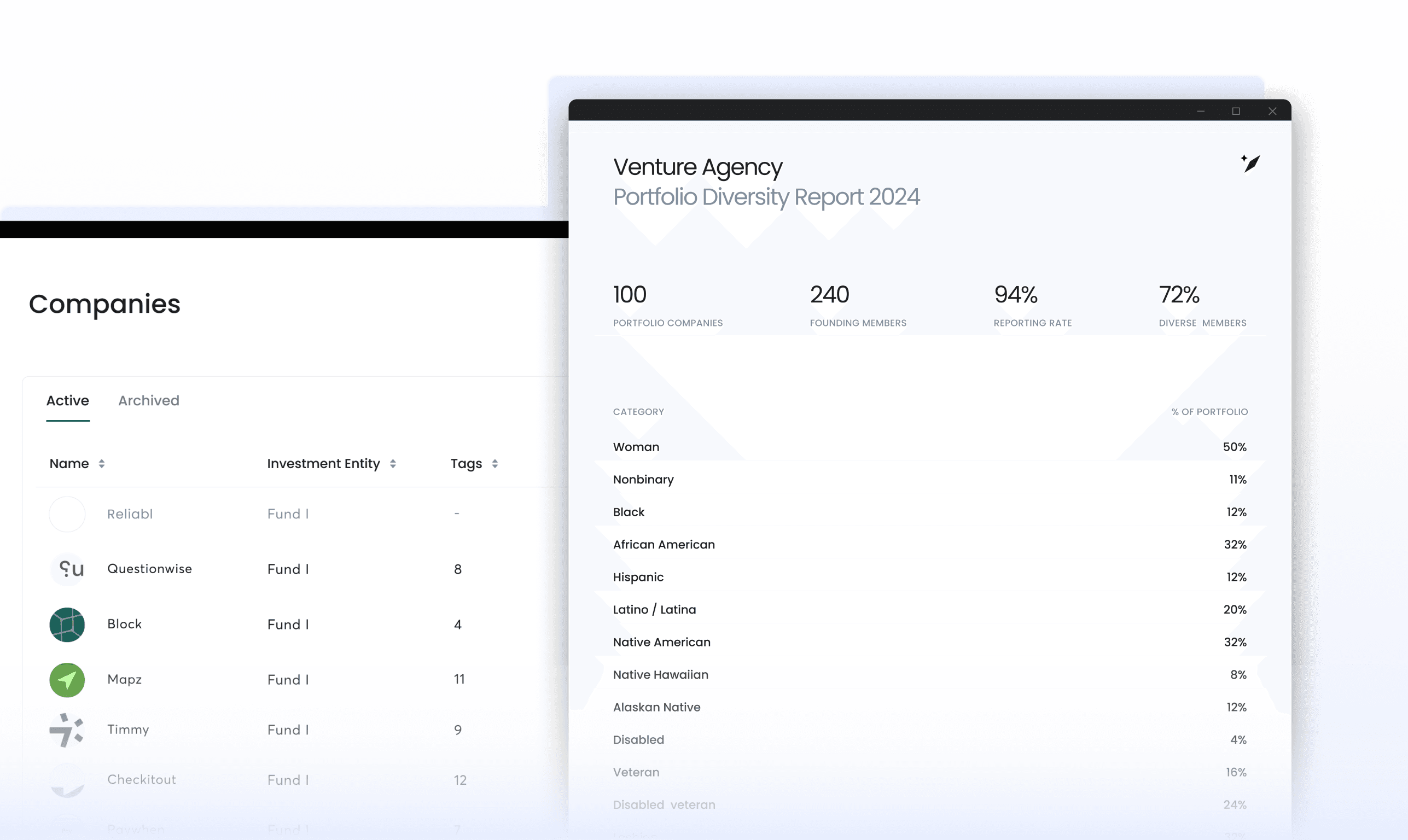

Automated Reports

Generate thorough diversity reports effortlessly, ensuring your firm meets all compliance standards and avoids fines.

AI-Ready Data

As VCs increasingly adopt AI tools for deal flow and due diligence, having accurate and inclusive data is more important than ever.

Self-Updating Tag Library

Stay current with the latest industry and demographic terminology and standards, automatically updated within our system.

How We Serve Founders

How We Serve Founders

Increased Data Privacy

Founder demographic data is stored in a HIPPA compliant database, preventing VCs from directly connecting sensitive data to any specific founder.

Founder demographic data is stored in a HIPPA compliant database, preventing VCs from directly connecting sensitive data to any specific founder.

Secure Collection

A safer alternative to collecting sensitive data, ensuring founder information remains protected, private, and anonymous.

A safer alternative to collecting sensitive data, ensuring founder information remains protected, private, and anonymous.

Single Reporting

Say goodbye to repetitive surveys. With Data Compass, founders only need to update personal and company data on a universal profile which is then shared with all approved investors.

Say goodbye to repetitive surveys. With Data Compass, founders only need to update personal and company data on a universal profile which is then shared with all approved investors.

Enhanced Ecosystem Diversity

By using Data Compass, founders contribute to a more inclusive VC ecosystem, fostering better opportunities for all.

By using Data Compass, founders contribute to a more inclusive VC ecosystem, fostering better opportunities for all.

Join Our Newsletter

Sign up for our newsletter to stay updated on product updates and regulatory changes.

🔒 We’ll never share your information with third parties.

A Smarter Way To

Collect Founder DataWith traditional surveys, data is often not easily queryable and requires additional steps before it can be used for AI or reporting. Data Compass manages founder data so that it is prepped for advanced use at collection.

Additionally, to comply with California Senate Bill 54, VCs can only view aggregated data, an impossible task with traditional surveys. DEI Compass securely stores and aggregates data, ensuring compliance.

CA Senate Bill 54 Compliance

California Senate Bill 54, also known as the VC Diversity Bill, requires venture capital firms with operations in California or at least one California-based company in their portfolio to report their diversity data by March 2025. This bill mandates the secure collection and aggregation of diversity data to enhance transparency and accountability within the venture capital industry. Failure to report this data could result in a $100,000 fine.

Reliabl's Data Compass simplifies compliance with SB54 by enabling secure, HIPAA-compliant data collection and producing aggregated reports for each fund within your firm. These reports can be easily published to your firm's website or sent directly from our platform to the reporting agency.

How Chasing Rainbows Transformed Their Reporting

Chasing Rainbows, a venture fund focused on investing in LGBTQ founders, faced the challenge of complying with evolving state regulations on reporting while meeting LP demands for detailed demographic data.

Traditional methods for collecting and reporting this data were unreliable and often failed to address the unique needs of a fund dedicated to underrepresented communities.To streamline their processes, Chasing Rainbows adopted Reliabl’s Data Compass. Data Compass allowed Chasing Rainbows to generate compliant and comprehensive reports effortlessly to meet regulatory requirements, as well as satisfy LP expectations.

A Smarter Way To

Collect Founder DataWith traditional surveys, data is often not easily queryable and requires additional steps before it can be used for AI or reporting. Data Compass manages founder data so that it is prepped for advanced use at collection.

Additionally, to comply with California Senate Bill 54, VCs can only view aggregated data, an impossible task with traditional surveys. DEI Compass securely stores and aggregates data, ensuring compliance.

CA Senate Bill 54 Compliance

California Senate Bill 54, also known as the VC Diversity Bill, requires venture capital firms with operations in California or at least one California-based company in their portfolio to report their diversity data by March 2025. This bill mandates the secure collection and aggregation of diversity data to enhance transparency and accountability within the venture capital industry. Failure to report this data could result in a $100,000 fine.

Reliabl's Data Compass simplifies compliance with SB54 by enabling secure, HIPAA-compliant data collection and producing aggregated reports for each fund within your firm. These reports can be easily published to your firm's website or sent directly from our platform to the reporting agency.

How Chasing Rainbows Transformed Their Reporting

Chasing Rainbows, a venture fund focused on investing in LGBTQ founders, faced the challenge of complying with evolving state regulations on reporting while meeting LP demands for detailed demographic data.

Traditional methods for collecting and reporting this data were unreliable and often failed to address the unique needs of a fund dedicated to underrepresented communities.To streamline their processes, Chasing Rainbows adopted Reliabl’s Data Compass. Data Compass allowed Chasing Rainbows to generate compliant and comprehensive reports effortlessly to meet regulatory requirements, as well as satisfy LP expectations.

A Smarter Way To

Collect Founder DataWith traditional surveys, data is often not easily queryable and requires additional steps before it can be used for AI or reporting. Data Compass manages founder data so that it is prepped for advanced use at collection.

Additionally, to comply with California Senate Bill 54, VCs can only view aggregated data, an impossible task with traditional surveys. DEI Compass securely stores and aggregates data, ensuring compliance.

CA Senate Bill 54 Compliance

California Senate Bill 54, also known as the VC Diversity Bill, requires venture capital firms with operations in California or at least one California-based company in their portfolio to report their diversity data by March 2025. This bill mandates the secure collection and aggregation of diversity data to enhance transparency and accountability within the venture capital industry. Failure to report this data could result in a $100,000 fine.

Reliabl's Data Compass simplifies compliance with SB54 by enabling secure, HIPAA-compliant data collection and producing aggregated reports for each fund within your firm. These reports can be easily published to your firm's website or sent directly from our platform to the reporting agency.

How Chasing Rainbows Transformed Their Reporting

Chasing Rainbows, a venture fund focused on investing in LGBTQ founders, faced the challenge of complying with evolving state regulations on reporting while meeting LP demands for detailed demographic data.

Traditional methods for collecting and reporting this data were unreliable and often failed to address the unique needs of a fund dedicated to underrepresented communities.To streamline their processes, Chasing Rainbows adopted Reliabl’s Data Compass. Data Compass allowed Chasing Rainbows to generate compliant and comprehensive reports effortlessly to meet regulatory requirements, as well as satisfy LP expectations.

A Smarter Way To

Collect Founder DataWith traditional surveys, data is often not easily queryable and requires additional steps before it can be used for AI or reporting. Data Compass manages founder data so that it is prepped for advanced use at collection.

Additionally, to comply with California Senate Bill 54, VCs can only view aggregated data, an impossible task with traditional surveys. DEI Compass securely stores and aggregates data, ensuring compliance.

CA Senate Bill 54 Compliance

California Senate Bill 54, also known as the VC Diversity Bill, requires venture capital firms with operations in California or at least one California-based company in their portfolio to report their diversity data by March 2025. This bill mandates the secure collection and aggregation of diversity data to enhance transparency and accountability within the venture capital industry. Failure to report this data could result in a $100,000 fine.

Reliabl's Data Compass simplifies compliance with SB54 by enabling secure, HIPAA-compliant data collection and producing aggregated reports for each fund within your firm. These reports can be easily published to your firm's website or sent directly from our platform to the reporting agency.

How Chasing Rainbows Transformed Their Reporting

Chasing Rainbows, a venture fund focused on investing in LGBTQ founders, faced the challenge of complying with evolving state regulations on reporting while meeting LP demands for detailed demographic data.

Traditional methods for collecting and reporting this data were unreliable and often failed to address the unique needs of a fund dedicated to underrepresented communities.To streamline their processes, Chasing Rainbows adopted Reliabl’s Data Compass. Data Compass allowed Chasing Rainbows to generate compliant and comprehensive reports effortlessly to meet regulatory requirements, as well as satisfy LP expectations.

REGULATORY SHIFTS

Diversity Reporting Laws

Starting March 1, 2025, all venture capital firms with at least one California-based company in their portfolio will be required to publish aggregated diversity data for each fund on their website. This is in accordance with California Senate Bill 54, a groundbreaking law aimed at increasing transparency and accountability in VC investments.

The legislation mandates the annual reporting of demographic data, including gender identity, race, ethnicity, disability status, LGBTQ+ identification, veteran status, and California residency of founding teams. This data must be collected and stored in a particular, secure manner in order to maintain compliance.

IMPACT

Driving systemic change in the VC industry

Our ongoing work with state and federal lawmakers as well as non-profits in the inclusive investment space underscores our dedication to improving DEI data transparency.

At Reliabl, we believe that diversity data tools should be developed by diverse teams of technologists, ensuring these products serve everyone, including traditionally marginalized groups.

#LGBTQIA+

#Neurodiverse

#BIPOC

#Woman

Ready to Transform Your Data Compliance Strategy?

Ready to Transform Your Data Compliance Strategy?

Schedule a demo and try our solution for free.

Schedule a demo and try our solution for free.

© 2024 Reliabl. All rights reserved.

team@reliabl.com

Address

1401 21st Street, STE R

Sacramento, CA 95811

REGULATORY SHIFTS

Diversity Reporting Laws

Starting March 1, 2025, all venture capital firms with at least one California-based company in their portfolio will be required to publish aggregated diversity data for each fund on their website. This is in accordance with California Senate Bill 54, a groundbreaking law aimed at increasing transparency and accountability in VC investments.

The legislation mandates the annual reporting of demographic data, including gender identity, race, ethnicity, disability status, LGBTQ+ identification, veteran status, and California residency of founding teams.

Starting March 1, 2025, all venture capital firms with at least one California-based company in their portfolio will be required to publish aggregated diversity data for each fund on their website. This is in accordance with California Senate Bill 54, a groundbreaking law aimed at increasing transparency and accountability in VC investments.

The legislation mandates the annual reporting of demographic data, including gender identity, race, ethnicity, disability status, LGBTQ+ identification, veteran status, and California residency of founding teams.

REGULATORY SHIFTS

IMPACT

Diversity Reporting Laws

Driving systemic change in the VC industry

Starting March 1, 2025, all venture capital firms with at least one California-based company in their portfolio will be required to publish aggregated diversity data for each fund on their website. This is in accordance with California Senate Bill 54, a groundbreaking law aimed at increasing transparency and accountability in VC investments.

The legislation mandates the annual reporting of demographic data, including gender identity, race, ethnicity, disability status, LGBTQ+ identification, veteran status, and California residency of founding teams.

IMPACT

Diversity Reporting Laws

At Reliabl, we are committed to driving systemic change in the VC industry. Our ongoing work with state and federal lawmakers underscores our dedication to improving DEI data transparency. We believe that diversity data tools should be developed by diverse teams of technologists, ensuring technologies meet the needs of the most marginalized.

By collaborating with key stakeholders and advocacy groups, Reliabl is at the forefront of creating a more equitable investment landscape.